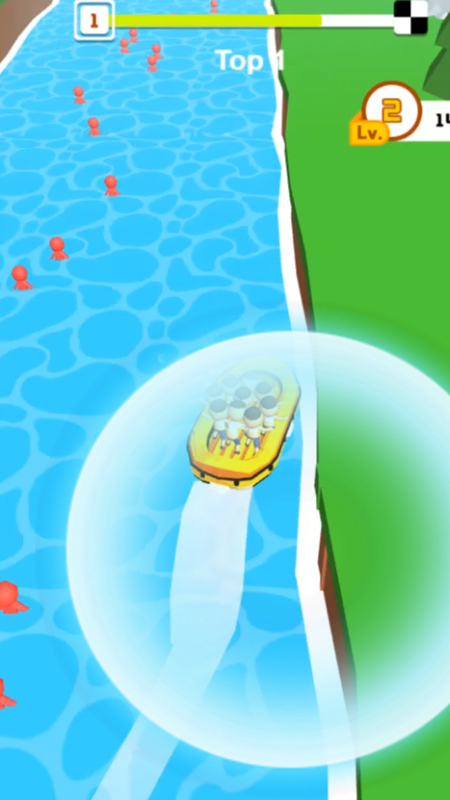

Scivoli scivolosi

Jei esate pakankamai sumanus, pasitraukite iš kelio ir tieskite tiltus bei naudokite nuorodas, kad pasiektumėte finišo liniją anksčiau nei visi kiti!Sukčiavimas dar niekada nebuvo toks stilingas!

Jei esate pakankamai sumanus, pasitraukite iš kelio ir tieskite tiltus bei naudokite nuorodas, kad pasiektumėte finišo liniją anksčiau nei visi kiti!Sukčiavimas dar niekada nebuvo toks stilingas!

Lavora come canoista di salvataggio in un simulatore di salvataggio in caso di catastrofe.Jei esate pakankamai sumanus, pasitraukite iš kelio ir tieskite tiltus bei naudokite nuorodas, kad pasiektumėte finišo liniją anksčiau nei visi kiti!Sukčiavimas dar niekada nebuvo toks stilingas!Paprastas žaidimas su efektyviais ir lengvai išmokstamais valdikliais.

This website stores data such as cookies to enable site functionality including analytics and personalization. By using this website, you automatically accept that we use cookies.